Black Friday has landed. But will it stay?

November 2022 - Performance

There's no denying that today is one of the biggest shopping events of the year. And, with a looming recession and a cost of living crisis, is this year's event set to be bigger than ever? Or, with increasing union strikes and brands boycotting the event all-together, is Black Friday soon to be a thing of the past?

Alexander Svensson, Senior Creative Content Strategist at Brave Bison has consulted our data analysts and gone to the farthest corners of the internet and back to bring you the very latest Black Friday research and stats.

Alexander looks at the numbers and explores whether more brands are actually boycotting Black Friday, whether internet sales are expected to drop to an all-time low as we return to a hand-sanitiser free in-store shopping experience. Or whether we're set to see the biggest Black Friday ever as shoppers set out to grab a Christmas bargain amidst economic uncertainty.

Alex, over to you...

Let's start at the very beginning...

The history of Black Friday... The most commonly repeated story behind the Thanksgiving shopping-related Black Friday tradition links it to retailers. As the story goes, after an entire year of operating at a loss (“in the red”) stores would supposedly earn a profit (“went into the black”) on the day after Thanksgiving, because holiday shoppers blew so much money on discounted merchandise. Though it’s true that retail companies used to record losses in red and profits in black when doing their accounting, this version of Black Friday’s origin is the officially sanctioned—but inaccurate—story behind the tradition.

Ok, so scrap that, what’s the real story then?

This actually dates back to 1950s Philadelphia where local police used the term to describe the chaos that ensued on the day after Thanksgiving, when hordes of suburban shoppers and tourists flooded into the city in advance of the big Army-Navy football game held on that Saturday every year.

Not only were Philly cops not able to take the day off, but they had to work extra-long shifts dealing with the additional crowds and traffic. Shoplifters also took advantage of the bedlam in stores and made off with merchandise, adding to the law enforcement headache.

By 1961, “Black Friday” had caught on in Philadelphia, to the extent that the city’s merchants and boosters tried unsuccessfully to change it to “Big Friday” in order to remove the negative connotations. The term didn’t spread to the rest of the country until much later, however, and as recently as 1985 it wasn’t in common use nationwide.

Sometime in the late 1980s, however, retailers found a way to reinvent Black Friday and turn it into something that reflected positively, rather than negatively, on them and their customers. The result was the “red to black” concept of the holiday mentioned earlier, and the notion that the day after Thanksgiving marked the occasion when America’s stores finally turned a profit.

The Black Friday story stuck, and pretty soon the term’s Philadelphia roots were largely forgotten. Since then, the one-day sales bonanza has morphed into a four-day event, and spawned other “retail holidays” such as Small Business Saturday/Sunday and Cyber Monday. Stores started opening earlier and earlier on that Friday, and now the most dedicated shoppers can head out right after their Thanksgiving meal.

Source: History Channel

USA: Where it all started...

Since becoming common practice in the early 90s, Black Friday is today considered the biggest retail event in North America, with retailers around the world consistently trying to beat each other on deals and opening hours.

In recent years, the adoption of Black Friday has also become more and more prevalent globally. Currently, of the world’s 195 countries, an estimated 50-60% “celebrate” Black Friday in some form or another. For example, in Europe, the United Kingdom, France, and Germany all started to adopt Black Friday within the last 10 years. Central and South American countries have also started promoting Black Friday. China and southeast Asia participate in Black Friday, and almost half of Africa celebrates Black Friday in some way.

Source: The Wordpoint; Junglescout (via Statista, Kiva)

UK: Move over Boxing day…

Traditionally in the UK, Boxing Day had been considered the biggest shopping day of the year. In the 2010s, several American-owned retailers such as Amazon UK and the Walmart-owned chain Asda, began to hold U.S.-style Black Friday promotions; in 2014, more British retailers began to adopt the concept, including Argos, John Lewis, and Very.

In 2016, total spending on online retail sites on Black Friday was £1.23 billion, a 2.2% year-over-year increase over 2015. In 2017, UK retail sales in November grew faster than in December for the first time.

So, what do the numbers tell us?

UK: 2022 Stats and Predictions

A new report predicts that retail sales will hit £8.71bn as consumers shop early for Christmas.

According to the VoucherCodes.co.uk 'Shopping for Christmas 2022: Black Friday Weekend report' two-fifths of consumers expect to spend more this year than last year over the four day period. Although they predict that sales on Black Friday itself will fall by 5.8% to £3.01bn, as consumers watch the World Cup instead of spending.

With several retailers set to extend their Black Friday promotions to a two-week period, the report forecasts shoppers will spend a total of £22.62bn across “Black Friday Fortnight” (November 22 to December 5), a 2.1% (£463m) increase on the same period in 2021.

Amid some forecasting a 3% dip in consumer spending this Christmas due to the cost-of-living crisis, the report credits this rise in spend to consumers taking advantage of the deals and discounts on offer over the Black Friday period to stock up on Christmas essentials.

As a result of the cost-of-living crisis, consumers are also set to begin Christmas shopping earlier to spread the cost, spending more than in previous years during the Black Friday period.

Despite the strain on many consumers’ budgets, two-fifths of consumers still say they are likely to make a purchase over the Black Friday Weekend (39%), and 16% say they are very likely to purchase. A further two-fifths say they are likely to spend more this year than last year (41%).

Retailers of clothing and footwear are the most likely to see a Black Friday sales boost, as this category is poised to be the most popular, with half of Black Friday shoppers set to make a purchase (47%).

Big ticket items such as electricals are also set to be popular (44%), as will gifting categories such as toys (37%), health and beauty (32%), and games, music and film (24%).

Looking at each day of the Black Friday Weekend individually, Cyber Monday is set to be the most lucrative day for retailers, generating £3.17bn, a rise of 0.3% year-on-year (YoY). However, sales on Black Friday itself are expected to fall by -5.8% to £3.01bn from £3.20bn last year.

With Black Friday taking place on the same day as England’s match against the USA in the FIFA World Cup, it is expected that many consumers will be tuning into the match from 7pm instead of shopping. As a result, this spend is set to shift to the Saturday and Sunday with expected sales of £2.53bn – a rise of 10.4% year on year.

This year’s Black Friday Weekend is the first year since 2019 without any Covid restrictions and, as a result, many consumers will return to bricks-and-mortar stores to shop in-person.

Due to this shift, offline sales are forecast to rise by 21.1% YoY from £3.22bn in 2021 to £3.9bn in 2022. However, with the rise in offline spend comes a decline in online spend from £5.42bn to £4.8bn – a drop of 11.2%.

Source: Decision Marketing

Black Friday 2022 Takeaways (UK)

Two-fifths of consumers expect to spend more this year than last year

Shoppers taking advantage of sales period for Christmas shopping amid cost-of-living crisis

Clothing and footwear, and electricals, set to be most popular categories

Extended sales period, up to two weeks

First return to brick and mortar since 2019, could mean rise in offline spend and decline in online

World cup stealing eyeballs, but creating opportunities too

An alternative approach – brand campaigns and boycotts

While Black Friday has seen YoY growth globally, an increasing number of brands are taking a stance against the consumerist holiday, pointing to reasons such as:

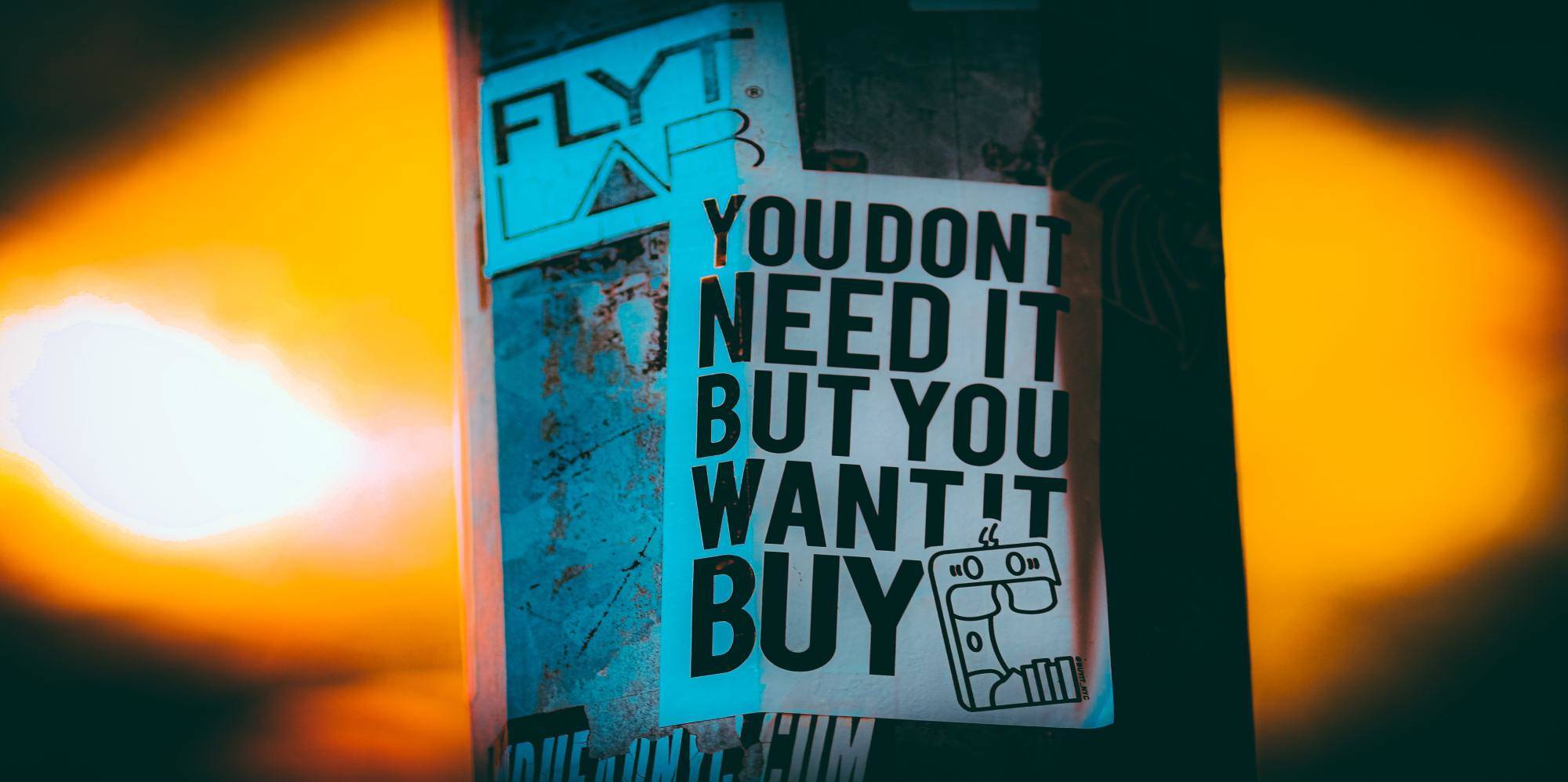

Excess consumption. Buying clothes and other items that are not necessarily needed is encouraged by the huge discounts.

Excess waste. 80% of clothes from Black Friday sales end up in landfill.

Unfair competition. Small and local businesses cannot compete with the large discounts offered by big retailers.

Deciem: It’s hard not to be swayed by heavy discounts and bargain promises. Deciem (Niod, The Ordinary) makes a case of opting out of the furore entirely, encouraging skincare fans to shop slowly and mindfully with a month-long 23% “slow” sale, whilst closing their online and offline stores throughout the holiday weekend.

Clothing brand Raeburn has pledged allegiance to the ‘boycott Black Friday’ movement by closing their physical and online stores during the holiday. With the introduction of their ‘Buy Nothing, Repair Something’ campaign, where customers could bring any clothing to their stores for free repairs, they also incentivise customers to wear their clothes for longer to reduce the fashion industry’s environmental impact.

For its 2020 Black Friday promotion, IKEA launched #BuybackFriday, repurchasing IKEA furniture to give it another life. The company followed it in 2021 by celebrating Green Friday all month with its Buy Back & Resell service in 33 stores across the U.S. from November 1 to December 5 and its Sustainable Living Shop in all U.S. locations, offering discounts on sustainable products.

In 2021, Google celebrated its second annual Black-owned Friday, a partnership with the U.S. Black Chambers, Inc., which reimagines Black Friday. To promote the event, musician and Nappy Boy Entertainment founder T-Pain wrote and produced a track and a shoppable video featuring more than 100 products from more than 50 Black-owned businesses. For the event, Google highlighted Black-owned businesses with a badge on Search, Maps, and Shopping.

While other companies spent Black Friday slashing prices for the most sensational sale of the year, Allbirds did diametrically the opposite. Instead of lowering prices, Allbirds raised them by $1, and all for a good cause. With every product sold, they matched and donated the extra $1 to environmental projects, working with organisations such as Fridays for The Future.

Cards Against Humanity has used multiple Black Fridays to run satirical promotions. In 2021, the game’s creators paid $5 to site visitors to perform various tasks. For example, donating teeth and asking Hellmann’s to bring back “Clam-o-naise.” In 2018, the promotion was a 99% off sale, with a new item every 10 minutes, including a used Ford Fiesta and medieval weapons. In 2020, Cards Against Humanity set aside the $250,000 for the planned Black Friday promotion and instead donated it to five charities.

And, of course, when it comes to Black Friday campaigns, Patagonia has always taken a “go against the grain” approach, famously kickstarted by that ad. Rather than hosting a sale, they’ve become renowned for their “Buy Less, Demand More” campaign.

Source: Practical eCommerce; The sustainable agency

Thanks, Alex!

...so, there you have it. The truth is, whether your brand is getting involved in the Black Friday sales or not, you'll need to be just as ready as the others. Demand is up and search is there. So sale or no sale, you'll need a site that works, that doesn't just handle excessive traffic but still provides an excellent customer experience.

And, for those of you braving the Black Friday event... then you'll need to find ways to cut through the noise and stand out. How do you compete with the a world wide sale? How can you take advantage of the event and push your hard-to-sell products? You'll need to be prepared.

Take our Black Friday campaign for New Balance last year, for example. The brief? To drive incremental revenue for them at a return on ad spend (ROAS) of 3.6 across the United Kingdom, Germany, and France. What did we achieve? We drove an ROI of 4.58 - 30% higher than our goal, with 46% lower CPA. How? You can see our case study here.

When it comes to campaign planning, we understand that every business is on a different journey, some have the luxury of time, others don't. But that shouldn't restrict what you're capable of. For some of our clients, we started planning their Black Friday campaigns moments after last year's event, for others a few months ago, and for some just weeks ago...

From influencer marketing to PPC to marketplace management to innovative commerce tech, and more... we are right by your side when you need it most. Helping you create, plan and execute to help your business cut through the noise and get the growth you deserve.

Interested in partnering with us? Drop us a message, or take a look at what we do. We may be Bisons, but we don't bite. Promise.